PACCAR (PCAR)·Q4 2025 Earnings Summary

PACCAR Posts Surprise Revenue Beat as Parts & Financial Services Hit Records

January 27, 2026 · by Fintool AI Agent

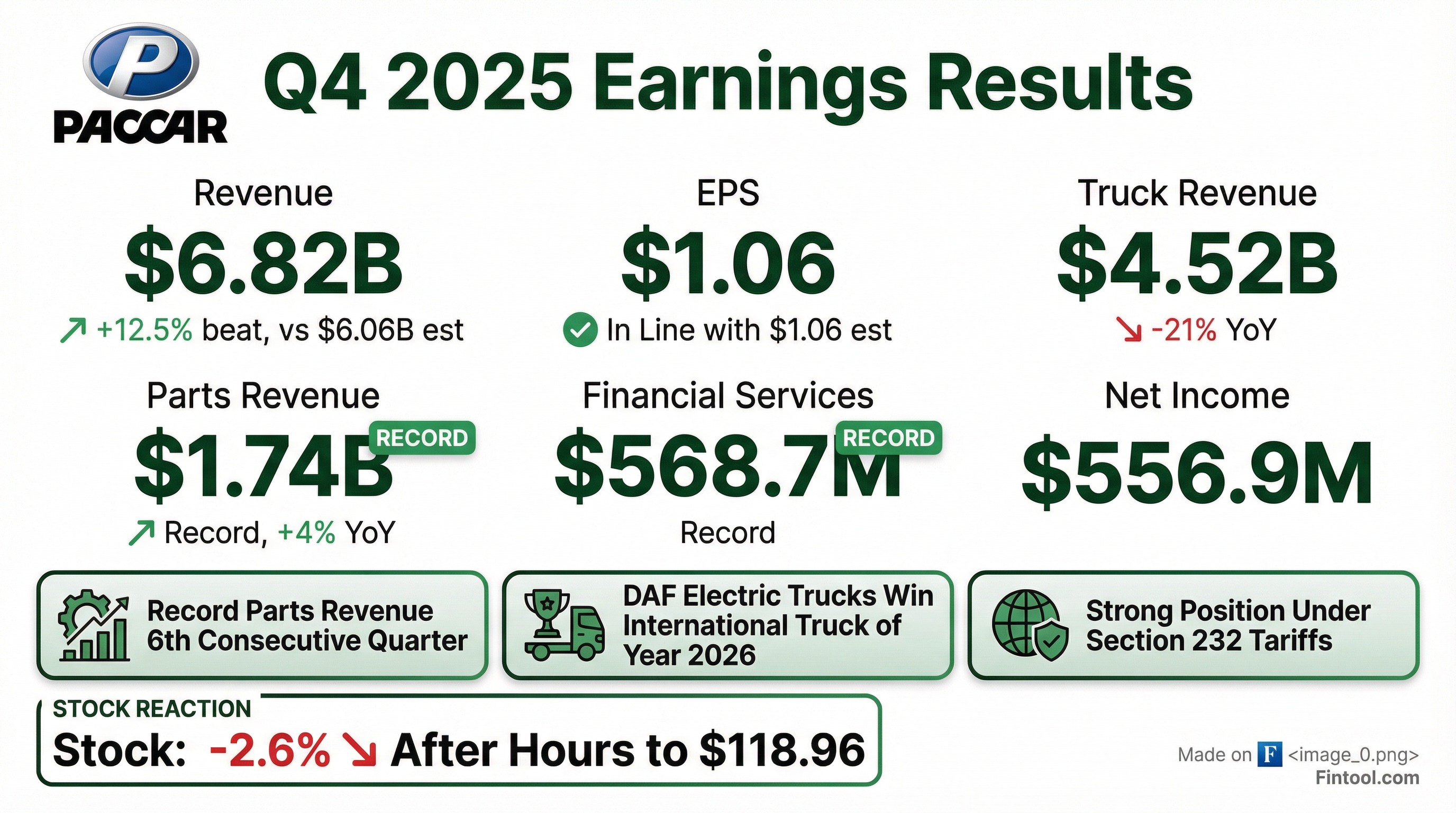

PACCAR delivered a surprise revenue beat in Q4 2025, with consolidated revenues of $6.82 billion coming in 12.5% above the $6.06 billion consensus estimate . EPS of $1.06 matched Street expectations . Despite the top-line beat, shares opened down 4.6% at $116.50 before recovering to close at $121.01 (-0.9%), as investors digested the strong order trends and margin improvement guidance alongside the -36% year-over-year earnings decline. Management struck an optimistic tone, noting Q1 gross margins should improve to 12.5%-13% and calling 2026 a "year of accelerated growth" .

Did PACCAR Beat Earnings?

The revenue beat was broad-based across segments, though EPS came in exactly at consensus expectations. This marks the fourth consecutive quarter where revenue has beaten estimates but EPS has disappointed or just met expectations — a pattern reflecting margin compression as the truck cycle softens .

Beat/Miss History (Last 8 Quarters):

What Changed From Last Quarter?

Improving Signs:

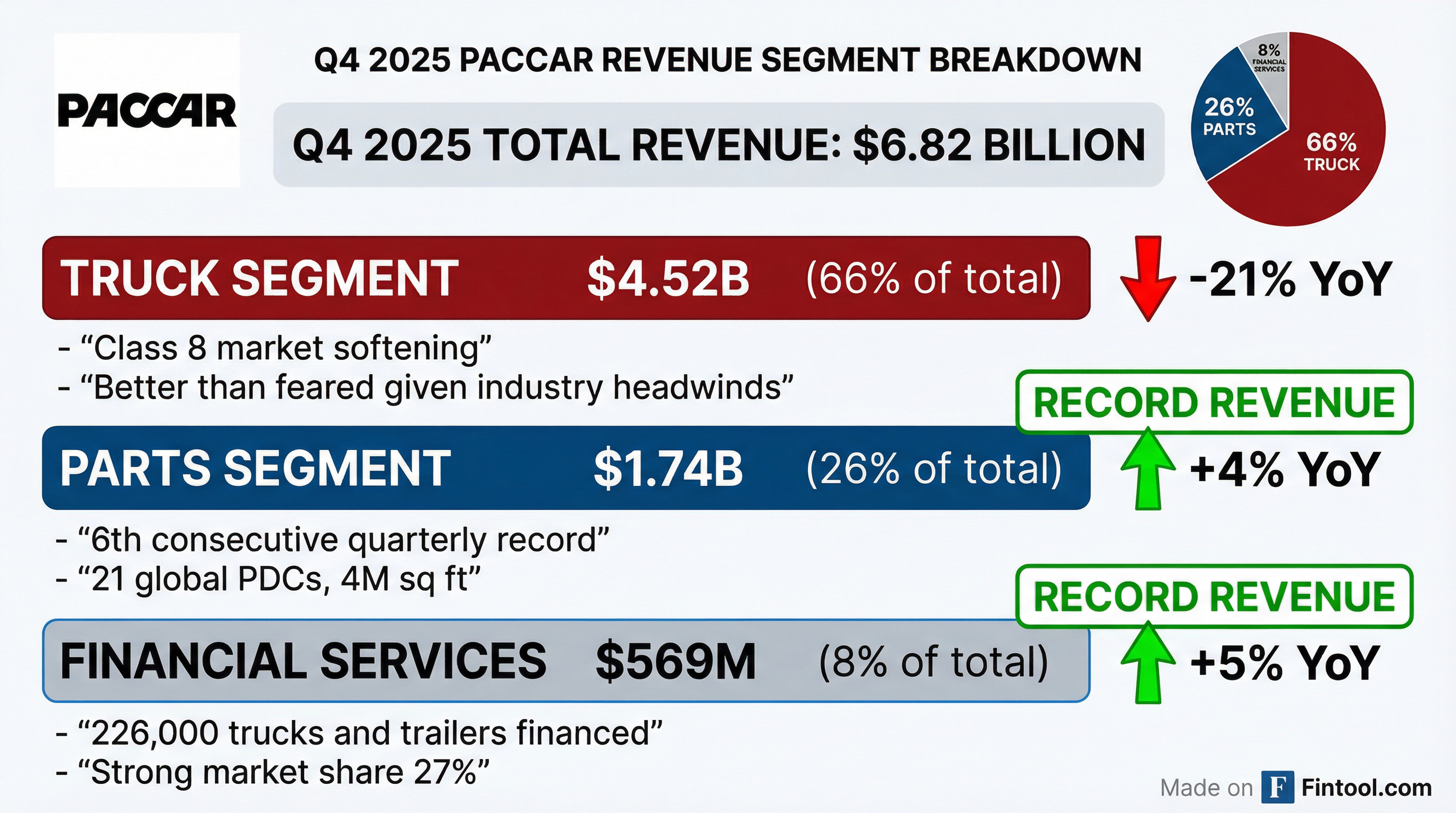

- Record Parts revenue of $1.74B (+4% YoY), the sixth consecutive quarterly record

- Record Financial Services revenue of $568.7M (+4.5% YoY) with pretax income up 10%

- Management cited "early improvements in freight fundamentals" that "should lead to a stronger truck market in 2026"

- DAF XF and XD Electric trucks won International Truck of the Year 2026

Deteriorating Signs:

- Truck segment revenue declined 21% YoY to $4.52B

- Global truck deliveries fell 25% to 32,900 units (vs 43,900 in Q4 2024)

- Gross margin continued compressing to ~12% from 16% a year ago

- Full-year net income of $2.38B was 43% below 2024's $4.16B

What Did Management Guide?

PACCAR provided industry volume guidance but not specific company financial targets:

Capital Allocation (2026):

- Capital investments: $725-775M (vs $728M in 2025)

- R&D spending: $450-500M (vs $446M in 2025)

Management struck a cautiously optimistic tone, noting: "Industry truck orders increased in December... The truck market is responding to the clarification of tariff policy and emissions regulations, which combined with early improvements in freight fundamentals, should lead to a stronger truck market in 2026" .

Regulatory Clarity:

- EPA re-affirmed EPA27 NOx limit at 35 milligrams, providing "clarity to the market and help customers make buying decisions"

- PACCAR positioned well under Section 232 truck tariffs with factories in U.S., Canada, and Mexico serving local markets

- EPA27 expected to add approximately $10,000 to new truck prices starting January 2027

Q1 2026 Guidance:

- Truck deliveries: Comparable to Q4's 32,900 units, with U.S./Canada up slightly, Europe down slightly

- Gross margins: Expected to improve to 12.5%-13% (vs 12% in Q4) due to Section 232 benefits, stable production, and reduced overtime

- Parts growth: +3% YoY expected in Q1, accelerating through the year

Q&A Highlights — What Investors Asked

Order Trends: Strong December-January Momentum

Management noted "very strong order intake in December and through January" with orders continuing "at a significant overbuild rate" . Q1 delivery slots are "mostly full" and backlog is building .

Section 232: Competitive Advantage Materializing

CEO Preston Feight highlighted that PACCAR's local-for-local manufacturing strategy now provides a cost advantage: "Throughout 2025, there was a bit of a disadvantage. And now I think we anticipate that to be an advantage" . Notably, competitors "haven't taken that tariff cost to the market yet," creating pricing uncertainty that benefits PACCAR: "We've been able to give customers clarity from our standpoint... which should be good for us through the year, both from a market share standpoint and a margin standpoint" .

Inventory Positioning: Below Industry Levels

Industry Class 8 inventory stands at 3.2 months while PACCAR is at 2.2 months — "an optimal spot" per management. Dealers are placing stock orders and bodybuilders are securing production slots for 2026 .

Used Truck Values: Upside Ahead

Used truck values increased 4% YoY and management expects further appreciation as EPA27 price increases make older model years relatively more attractive .

Supply Chain Capacity

When asked about supply chain bottlenecks, management acknowledged that if second-half build rates ramp significantly, supplier capacity could become constrained: "If the ramp is too significant, it becomes bounded. We don't see that yet, but we don't rule out that could happen" .

Price-Cost Dynamics

Q4 margins were impacted by overtime costs and factory transitions for local-for-local production. Q1 should benefit from stable production, full-quarter Section 232 benefits, and no recurring overtime costs .

How Did the Stock React?

PCAR shares closed at $122.11 before the report but opened down 4.6% at $116.50 in what appeared to be an initial knee-jerk reaction. However, as investors digested the strong order trends and Q1 margin improvement guidance, shares rallied throughout the session to close at $121.01 (-0.9%).

Initial concerns addressed on the call:

- Margin recovery path — Q1 guidance of 12.5%-13% gross margins (vs 12% in Q4) showed improvement trajectory

- Order momentum — Strong December-January orders and "mostly full" Q1 slots reassured bulls

- Section 232 advantage — Local-for-local manufacturing providing competitive edge

The stock is up 43% from its 52-week low of $84.65 and trading just 3% below its 52-week high of $124.53, reflecting confidence in the cycle recovery narrative.

Key Segment Performance

Truck Segment — Challenged but Positioned Well

- Q4 Revenue: $4.52B (-21% YoY)

- Q4 Pretax Profit: $94.6M (-81% YoY)

- U.S./Canada Market Share: 30% in 2025

- Europe Heavy-Duty Market Share: 13.5%

- Global Deliveries: 144,200 vehicles in FY2025 (-22% YoY)

- Cost Structure: Materials represent 80-85% of COGS

PACCAR maintained its premium market position with 30% U.S./Canada Class 8 retail sales share. The new Kenworth and Peterbilt battery-electric trucks and DAF's International Truck of the Year award demonstrate continued product leadership .

PACCAR Parts — Record Performance

- Q4 Revenue: $1.74B (+4% YoY) — RECORD

- Q4 Gross Margin: 29.5%

- Q4 Pretax Income: $415M (-3% YoY)

- FY2025 Revenue: $6.87B (+3% YoY) — RECORD

- 2026 Growth Outlook: 4%-8%, with growth accelerating through the year

Parts provides "strong foundational profitability through all phases of the business cycle" per management . The new distribution center in Calgary expands the network to 21 PDCs . Management highlighted that "agentic AI tools" are helping identify required maintenance and optimize inventory mix at distribution centers and dealers .

PACCAR Financial Services — Strong Fundamentals

- Q4 Revenue: $568.7M (+4.5% YoY) — RECORD

- Q4 Pretax Income: $114.9M (+10% YoY)

- Portfolio: 226,000 trucks and trailers, $22.8B in assets

- Retail Market Share: 27% in 2025

What Should Investors Watch?

Near-Term Catalysts:

- Analyst Day: February 10, 2026 — Management will share more details on "advanced transportation solutions, data, connectivity" and cycle-over-cycle profitability targets

- Q1 2026 truck order trends — December orders increased; continuation would validate management's optimism

- EPA27 implementation timeline and customer pre-buy behavior (expected $10,000/truck price increase)

- Freight rate trends and fleet profitability recovery — "We're just in the beginning parts of having the truckload carrier profitability return"

Risks:

- Further margin compression if volumes disappoint

- South American market deterioration (guidance suggests -4% to -13% decline)

- Potential tariff escalation beyond current Section 232 framework (USMCA negotiations expected later in 2026 )

- Supply chain constraints if H2 build rates accelerate significantly

Long-Term Positives:

- Record Parts and Financial Services provide earnings floor

- Electrification investments (battery-electric trucks, agentic AI) position for future growth

- 87th consecutive year of profitability demonstrates franchise durability

- Connected truck data platform: "Our ability to have every truck be connected and gather petabytes of data from our trucks and then use that data to provide customer value is significant in the coming years"

Key Management Quotes

"We look forward to 2026 being a year of accelerated growth for our customers, dealers, and PACCAR." — Preston Feight, CEO

"Throughout 2025, there was a bit of a disadvantage. And now I think we anticipate that to be an advantage... Through the year, we feel good about our opportunity to gain in terms of margin and market share." — Preston Feight, CEO on Section 232 tariff benefits

"Cycle over cycle performance that teams have delivered is really significant and outstanding... As we look to the future, we feel great about the opportunities in front of us. It's not just trucks, and it's not just parts, and it's not just financial services." — Preston Feight, CEO on long-term strategy

Full Year 2025 Summary

The $264.5M after-tax charge related to EC civil litigation in Europe (Q1 2025) accounts for the difference between GAAP and adjusted figures .

Data as of market close January 27, 2026. After-hours price movements may not reflect next-day opening prices.